Top Medical Insurance Program to Safeguard Your Health

When it comes to prioritizing your well-being, choosing the best health insurance strategy is a critical choice. Understanding the nuances of top wellness insurance coverage plans, consisting of protection specifics, premiums, and added advantages like wellness programs, is important for making an educated choice that safeguards both your health and financial resources.

Trick Functions of Top Medical Insurance Plans

When assessing leading medical insurance plans, an important aspect to think about is their detailed insurance coverage options. A durable health and wellness insurance coverage strategy must provide insurance coverage for a vast array of clinical services, including hospital keeps, doctor check outs, prescription medicines, preventative treatment, and psychological health and wellness solutions. Comprehensive insurance coverage makes sure that individuals and family members have accessibility to the treatment they require without encountering significant economic problems.

Additionally, top medical insurance plans typically use fringe benefits such as coverage for different therapies, pregnancy treatment, and vision and dental services (Health insurance agent near me). These extra benefits can assist people tailor their insurance coverage to meet their details medical care requirements

Additionally, top medical insurance strategies usually have a broad network of medical care providers, consisting of healthcare facilities, doctors, specialists, and pharmacies. A durable network makes certain that participants have accessibility to top quality care and can conveniently discover medical care companies within their protection area.

Comparison of Premiums and Insurance Coverage

Premiums and coverage are crucial factors to think about when comparing various wellness insurance coverage plans. Costs are the amount you pay for your health and wellness insurance protection, typically on a regular monthly basis. When contrasting premiums throughout various strategies, it is very important to look not just at the cost but additionally at what the premium consists of in regards to protection. Reduced premiums may indicate greater out-of-pocket prices when you require healthcare, so discovering an equilibrium between premium costs and insurance coverage is vital.

Protection describes the services and benefits provided by the medical insurance strategy. This consists of doctor visits, hospital keeps, prescription medications, preventative care, and various other medical care services. When contrasting coverage, think about factors such as deductibles, copayments, coinsurance, and coverage restrictions. A strategy with extensive insurance coverage may have higher costs but could inevitably save you money in the future by covering a greater part of your healthcare expenses. It's vital to assess your health care needs and spending plan to determine which plan offers the best value for you.

Benefits of Consisting Of Wellness Programs

An important element of health insurance coverage plans is the consolidation of health cares, which play a crucial role in promoting total wellness and preventive treatment. Health programs include a series of initiatives intended at improving people' well-being and reducing health and wellness risks. By including wellness programs in medical insurance plans, policyholders get to numerous resources and activities that concentrate on enhancing physical, psychological, and psychological wellness.

One significant benefit of including wellness programs is the focus on view it preventive care. These programs typically consist of routine health testings, vaccinations, and way of life training to aid people keep health and address prospective issues prior to they rise. Additionally, wellness programs can urge healthy and balanced habits such as normal exercise, well balanced nutrition, and anxiety management, inevitably leading to a much healthier way of life.

:max_bytes(150000):strip_icc()/GettyImages-1144854947-c7f45fd8855944578e503d57c36e4a0e.jpg)

Understanding Plan Limitations and Exclusions

Policyholders ought to be conscious of the constraints and exclusions described in their health insurance coverage intends to completely understand their insurance coverage. Exemptions, on the other hand, are specific services or conditions that are not covered by the insurance policy plan. It is recommended for insurance holders to assess their plan records meticulously and consult with their insurance service provider to clear up any type of unpredictabilities regarding protection constraints and exemptions.

Tips for Choosing the Right Strategy

When picking a health and wellness insurance coverage plan, it is vital to very carefully review your health care requirements and economic considerations. It's likewise important to review the network of medical care suppliers included in the plan to ensure your preferred doctors and healthcare facilities are covered.

Additionally, consider any kind of extra advantages offered by the plan, such as wellness programs, telemedicine services, or coverage for different treatments. By carefully analyzing your health care requirements and economic situation, you can choose a health and wellness insurance coverage plan that effectively safeguards your health.

Final Thought

Finally, choosing a top health and wellness insurance coverage plan is vital for safeguarding one's health. By comparing premiums and coverage, consisting of wellness programs, recognizing plan restrictions and exemptions, and picking the best strategy, people can guarantee they have the required protection in area. It is necessary to carefully take into consideration all elements of a medical insurance plan to make an enlightened decision that meets their particular requirements and gives satisfaction.

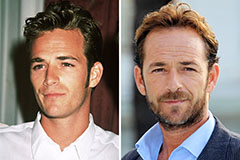

Luke Perry Then & Now!

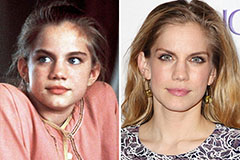

Luke Perry Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!